The largest annual inflation-based increase to the estate and gift tax exclusion amount (also known as the “Basic Exclusion Amount”) in United States history will become effective on January 1, 2023. The Basic Exclusion Amount will increase by $860,000 from the current amount of $12,060,000. This means that starting January 1, 2023, an individual can pass $12,920,000 ($25,840,000 for a married couple) at death or during life tax-free.

Why the large increase? High inflation plus the Tax Cuts and Jobs Act (TCJA).

Enacted in December 2017, the TCJA increased the Basic Exclusion Amount to $11,180,000, and it is adjusted annually for inflation. The annual increases are not set to last forever under existing law. Beginning on January 1, 2026, the Basic Exclusion Amount will be reduced to the pre-2018 level of $5,000,000, as adjusted for inflation.

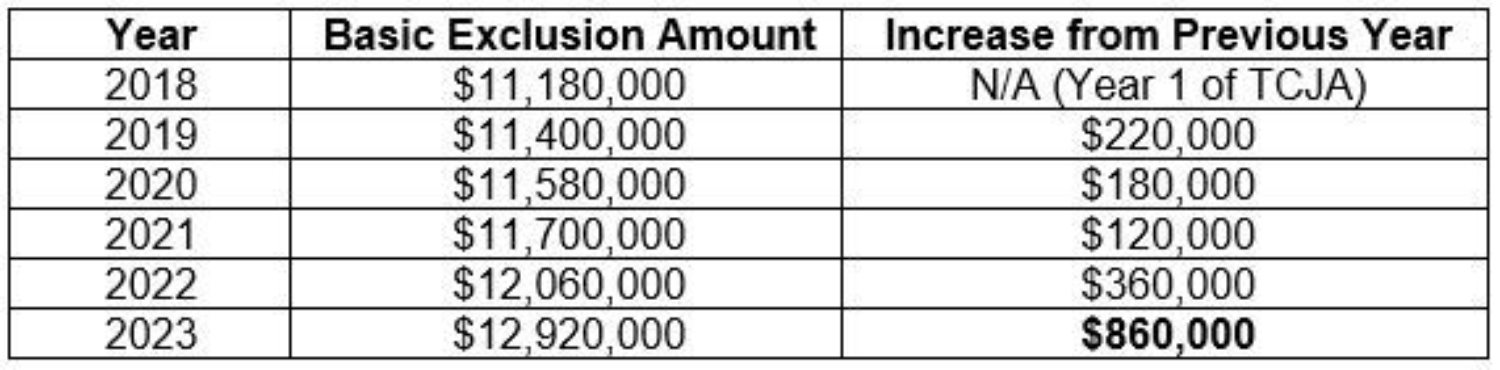

To understand why this upcoming year’s increase is gaining attention, we can look at the previous years’ annual adjustments for context.

The chart reveals that the largest prior increase was from year 2021 to 2022 in the amount of $360,000. This year’s increase from 2022 to 2023 is almost two and a half times that amount of $360,000, at $860,000.

The annual exclusion for gifts made during a single year will also increase by $1,000 to a total of $17,000 per beneficiary (the “Annual Exclusion Amount”). This means that during 2023, an individual can transfer cash or other property up to $17,000 in value to any person tax-free, without it counting against his or her Basic Exclusion Amount or requiring that a gift tax return be filed. The Annual Exclusion Amount applies to as many persons (related or unrelated) as the transferor makes gifts. For example, if a grandfather makes maximum annual exclusion gifts to his 3 children, 10 grandchildren, and 2 of his friends, he can move $255,000 out of his estate’s assets tax-free.

While some may rejoice in the news of increases to the Basic Exclusion Amount and Annual Exclusion Amount, it must be remembered that the increases are required by law and implemented by the IRS to prevent inflation from increasing taxes.

For additional information, please contact one of our Private Wealth, Trusts & Estates attorneys.

Jones Foster is a commercial and private client law firm headquartered in West Palm Beach, Florida. Established in 1924, the Firm has served as an integral part of South Florida’s growth and prosperity for nearly a century. Through a relentless pursuit of excellence, Jones Foster delivers original legal solutions that help clients, colleagues, and the community to move forward. The Firm’s attorneys focus their practice in Real Estate, Litigation & Dispute Resolution, Private Wealth, Trusts & Estates, Corporate & Tax, and Land Use & Governmental. For more information, please visit www.jonesfoster.com.